Why You Should Care About Robinhood Fees Right Now

In this post we analyze and explain Robinhood’s hidden fees, how they make money despite not charging any trading fees and why Swan’s fee structure is among the most customer friendly in the industry.

Swan Bitcoin and Robinhood’s fee structure is tailored to specific investor needs and trading behaviors.

Understanding each platform’s fee structure is crucial when selecting an investment platform. Fees can significantly impact overall investment returns, especially for frequent traders or those investing significant sums.

This comparison aims to unpack these fee structures and help investors identify which platform best suits their investment approach.

Robinhood is known for its zero-commission trading model on stocks, ETFs, options, and cryptocurrencies, which is highly beneficial for all transaction sizes: Swan Bitcoin’s fee structure is quite straightforward. Here’s an overview of how their fees work.

Commission-Free Trading

Robinhood is well-known for its commission-free trading model, which applies to stocks, ETFs, options, and cryptocurrency trading. This approach has been a significant draw for users, especially those new to investing.

This allows customers to trade without worrying about the cost per trade like those typically seen on other brokerage platforms.

Hidden and Regulatory Fees

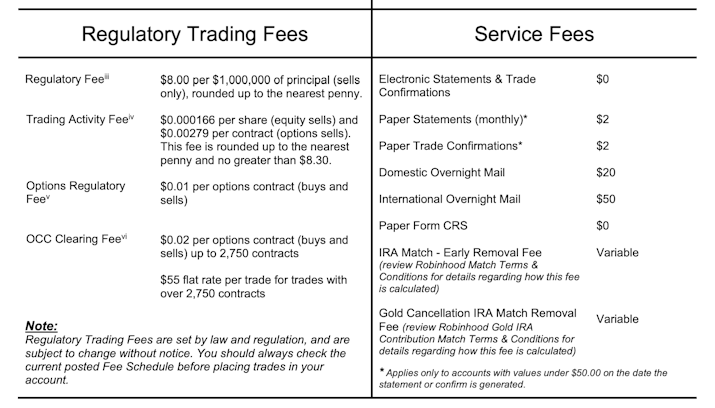

Despite offering zero-commission trades, Robinhood DOES pass on specific regulatory fees to its users. These include the Trading Activity Fee (TAF) and the Regulatory Transaction Fee, which are mandatory fees charged by regulatory bodies like FINRA and the SEC and are not marked up by Robinhood.

Users are also subject to fees for paper statement deliveries, overnight check deliveries and outbound asset transfers.

Revenue Generation Beyond Commissions

Robinhood compensates for its zero-commission model through several other revenue streams.

Market Maker Rebates

Robinhood earns a portion of its revenue through rebates from market makers and trading venues.

This practice, known as “payment for order flow,” allows Robinhood to receive compensation for directing orders to particular market makers for execution.

Robinhood Gold

Robinhood Gold is a premium service offers additional features such as increased instant deposit limits and access to margin trading. Robinhood charges a monthly fee for Gold subscriptions, including additional interest on margin used above a certain threshold.

Here are some of the key features and aspects of Robinhood Gold:

Enhanced Trading Capabilities: Robinhood Gold subscribers can access bigger instant deposit limits, which means they can use deposited funds instantly without waiting for the funds to settle.

Margin Trading: Robinhood Gold allows users to trade on margin, giving them access to borrowed funds to purchase stocks. This can increase both the potential gains and risks.

Additional Market Data: Subscribers get access to in-depth research and Level II market data from NASDAQ, which provides more detailed information about buy and sell orders in the market than is available through standard Robinhood accounts.

Interest on Margin: Robinhood Gold offers a competitive annual interest rate for money borrowed over $1,000. As a Gold member, you enjoy a lower rate, maximizing your potential profits.

Monthly Fee: The service costs $5 per month, including the first $1,000 margin. Beyond $1,000, additional interest fees apply based on the amount of margin used.

Other Benefits: Robinhood Gold members also benefit from priority customer support, which can be crucial for resolving issues quickly.

Robinhood Gold is suitable for traders who need more than the basic features offered in the free Robinhood account, especially those looking to utilize margin trading and who can benefit from faster access to deposited funds and more comprehensive financial data.

What Customers Dislike About Robinhood Fees

Hidden Charges

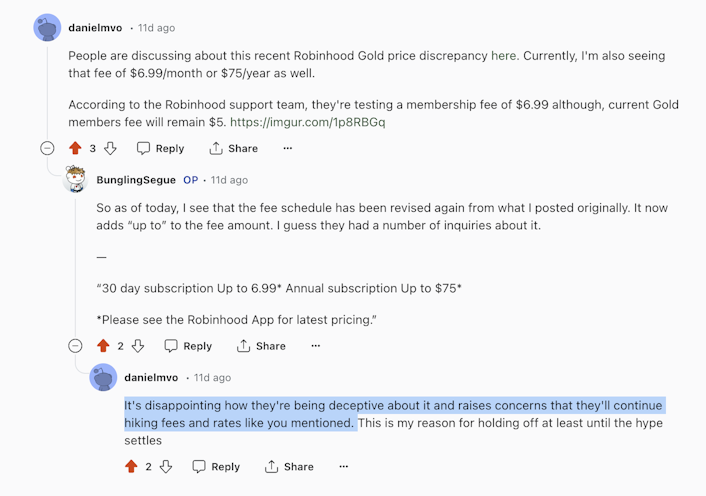

In March of 2024, a Reddit user noticed Gold fees would soon be raised.

The user included the below screenshot of the 'terms of service' change.

NOTE: It’s important to carefully read ALL the fine print, terms of service and consider the risks associated with margin trading, as it can significantly increase potential losses. For detailed information and the most current features, it’s best to visit Robinhood’s official site or contact their support directly.

Interest on Uninvested Cash

Interest is earned on eligible uninvested cash swept from your individual investment account to program banks. Program banks pay interest on your swept cash minus any fees paid to Robinhood.

The Annual Percentage Yield (APY)* is 1.5% as of August 11, 2022, or 5% for Robinhood Gold members as of November 15, 2023.

Margin Fees

For users who choose to trade on margin (borrowing money to trade), Robinhood charges an interest rate on the borrowed funds. This rate varies depending on whether the user is a Robinhood Gold member.

Gold members typically receive a lower rate than non-Gold members.

Through this multifaceted approach to revenue generation, Robinhood maintains a low-cost trading environment for its users while still operating profitably.

Swan primarily targets users interested in purchasing Bitcoin regularly through a 'recurring buys' model. Fees are directly related to the amount and frequency of purchases. Swan’s model makes it an especially appealing option for recurring low-time preference investors.

It combines low fees with additional savings for frequent purchases and successful referrals.

Trading Fees

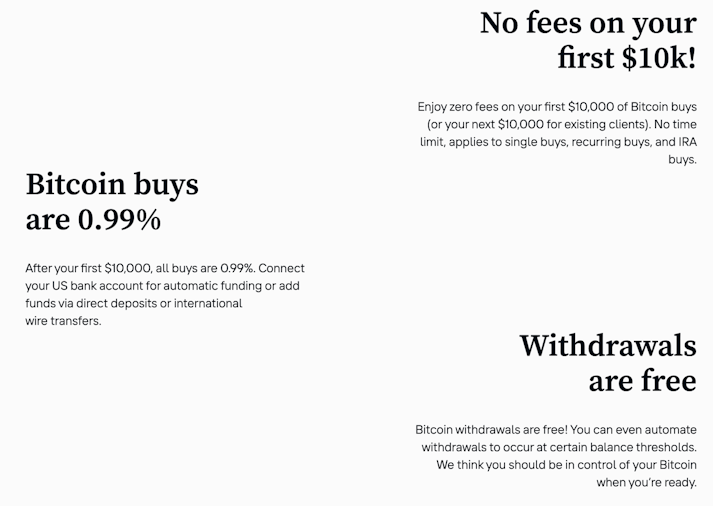

Right now, Swan customer have ZERO fees for their first or next $10,000 in Bitcoin purchases.

Swan Bitcoin has low commissions (0.99%) for all purchases and sales whether made instantly, via wire transfer, direct deposit, or as part of a recurring transfer plan. Depending on your purchasing size, your fees can be up to 80% cheaper at Swan than if you buy Bitcoin through another platform.

Additional Discounts and Programs

Referral Incentive Program (Receive a $10 Bitcoin Bonus)

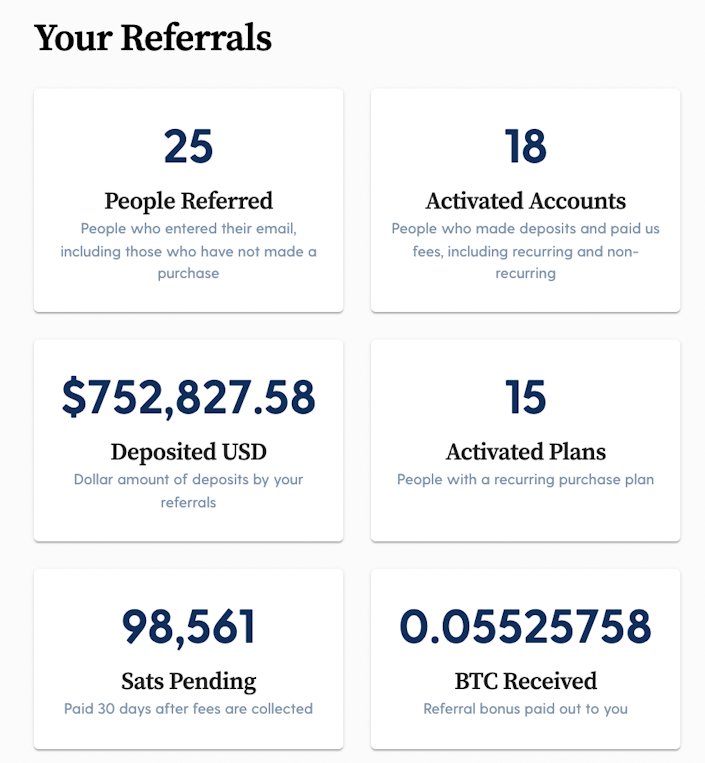

Swan is highly confident in the appeal of their service and has thus initiated the Swan Force Referral Initiative. This program is open to all who wish to become affiliates.

Enrolling in Swan Force is a breeze.

Once you’re in, you’ll be given a unique URL that you can easily share with others. If they decide to join Swan using your link, they’ll get a $10 bonus in Bitcoin. You’ll also earn 25% of their Bitcoin transaction fees for their first year’s purchases.

We’ve set up a dedicated referral dashboard for you to keep track of your referrals and earnings.

When comparing fee structures, it’s essential to understand how each platform charges for transactions and how these fees impact both small and large transactions.

For small transactions: The absence of commission fees makes Robinhood an attractive option for small transactions.

Small traders benefit from not paying a flat fee per trade, which can disproportionately affect smaller trade amounts.

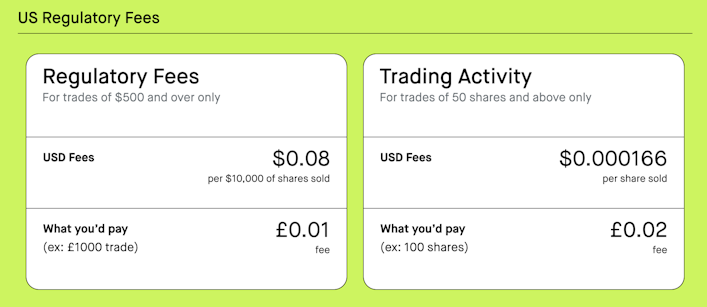

However, they still face small regulatory fees like the 'Trading Activity Fee, ' which is $0.000166 per share for equity sales.

For large transactions: While the lack of trading fees benefits larger transactions, Robinhood users must consider the impact of regulatory fees, which can accumulate based on the transaction size.

However, these fees are relatively minor compared to typical commission charges on other platforms.

Membership and Subscription Fees

When considering the membership and subscription fees between Swan and Robinhood, each platform offers different approaches catering to specific investors and services.

Swan Bitcoin Membership Fees

Swan Bitcoin focuses primarily on Bitcoin and does not charge general membership or account fees.

Robinhood Membership Fees

Robinhood offers a more traditional membership model through its Gold service.

Robinhood Gold costs $5 per month and includes additional perks like earning higher interest on uninvested cash. This service provides value to more active traders or those looking for deeper financial insights and quicker access to funds.

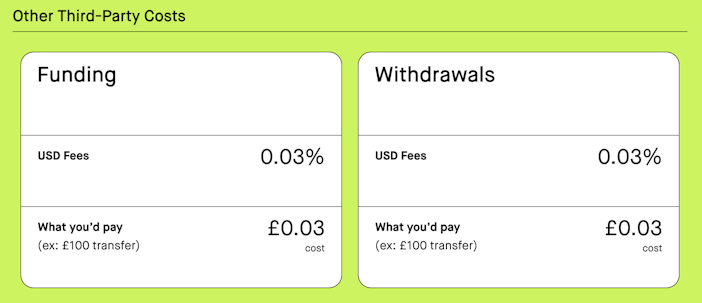

Both Swan and Robinhood have distinct fee structures beyond basic trading fees, including withdrawal, inactivity, and transfer fees. Understanding these can help users gauge the overall cost of using each platform.

Swan Bitcoin

Withdrawal Fees: Swan Bitcoin does NOT charge any fees for withdrawing Bitcoin to an external wallet, which is a significant benefit for users looking to move their Bitcoin to personal wallets or other exchanges.

No Inactivity Fees: Swan promotes regular purchasing but does NOT penalize users with inactivity fees, making it cost-effective for long-term holding without regular transactions.

Transfer Fees: There are NO fees for transferring funds in fiat.

Robinhood

Withdrawal Fees: Robinhood does not charge fees for ACH withdrawals but has wire transfer fees. Domestic wires are free, but international wire fees must be checked for hidden forex charges.

Inactivity Fees: Robinhood does not charge any inactivity fees, which makes it attractive for users who might not trade frequently.

Transfer Fees: Robinhood charges a $75 fee for outbound transfers (ACATS), a significant cost if a user moves their portfolio to another brokerage. However, depositing funds via ACH and withdrawing funds from a bank accountis free.

Swan Bitcoin

Swan is more cost-effective for those focused explicitly on frequent Bitcoin smash buys and those planning regular and substantial purchases.

Remember: Swan is Bitcoin-only.

Robinhood

Robinhood offers a broad approach to cryptocurrency trading with no commission fees, which might suit those looking to trade various cryptocurrencies without incurring high costs.

However, the depth of features specific to cryptocurrency trading might not be as robust as dedicated competitor crypto platforms.

Now, you are ready to take control of your Bitcoin and crypto investments with competitive fees! Don’t settle for fake Bitcoin with Robinhood. Start securing your financial future with Swan with the hardest money ever known to man.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Drew, a class of 2013 Bitcoiner, is a Research Analyst for Swan Bitcoin.

He has worked in institutional VC/PE, FinTech, and DLT consulting for over six years. He also brings over twelve years of experience working with national nonprofits and start-ups in education and software development in several leadership roles.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

Best Bitcoin ETF Fees: Lowest to Highest (May 2024)

By Matt Ruby

In this guide, we analyze and present the top 10 Bitcoin ETFs with the lowest fees for cost-effective investing.

Bitcoin Price Prediction 2030 & 2040 (May 2024 Update)

By Drew

Max Keiser predicts Bitcoin to be worth $200K in 2024. Fidelity predicts one Bitcoin will be worth $1B in 2038. Hal Finney predicted $22M per Bitcoin by 2045. Let’s look into why in more detail…

Best 5 Bitcoin & Crypto IRAs for May 2024: Which Wins?

By Drew

Bitcoin and crypto IRAs have exploded in popularity. This guide breaks down the most popular options in 2024 and will help you pick the best one for your goals and situation.