Hello Friends, Hoss here. With Swan, you are implementing a passive investing strategy to purchase bitcoin with competitive fees (0.99%); assuming you pre-pay your yearly fees and invest at least $50/week. Think of this like I’ll pay 25$ per year, to invest $2,500 per year, without ever having to think about it. The convenience fee of (0.99%) is what you are paying Swan for their buying service, user-experience, security, and the peace of mind knowing you are dollar-cost averaging your bitcoin purchases. I have personally tried manually DCA strategies in the past and it is an emotional practice that often results in purchasing at the wrong time or even preventing yourself from purchasing (you can’t time the market), as the nature of bitcoin’s price discovery is volatile; however, with a passive investing strategy I no longer need to think about it. If you invested $50/week over the last 3 years, your $7,500 would have been worth over $12,000. (2017-2020). This equates to roughly a 60% return through a bull mania and bear fallout period. 60% in 3 years. Try to do that in the equity market. As long as you invest $50/week and prepay your fee, you are guaranteed an industry leading fee of 0.99%. Thank you and happy bitcoining!

Strong Relationships

Bitcoin experts deliver personalized service to help you navigate Bitcoin with confidence.

Ironclad Security

With SOC 2 Type 2 compliance at its core, Swan Guard protects your assets so you can focus on growing wealth.

Exclusive Events

Virtual and in-person events give you direct access to the most knowledgeable people in Bitcoin.

Insightful Research

Swan Research keeps you educated and up-to-date about Bitcoin and the broader financial world.

Swan Vault

Advanced Bitcoin cold storage made simple.

Swan IRA

More than a plan. A partnership.

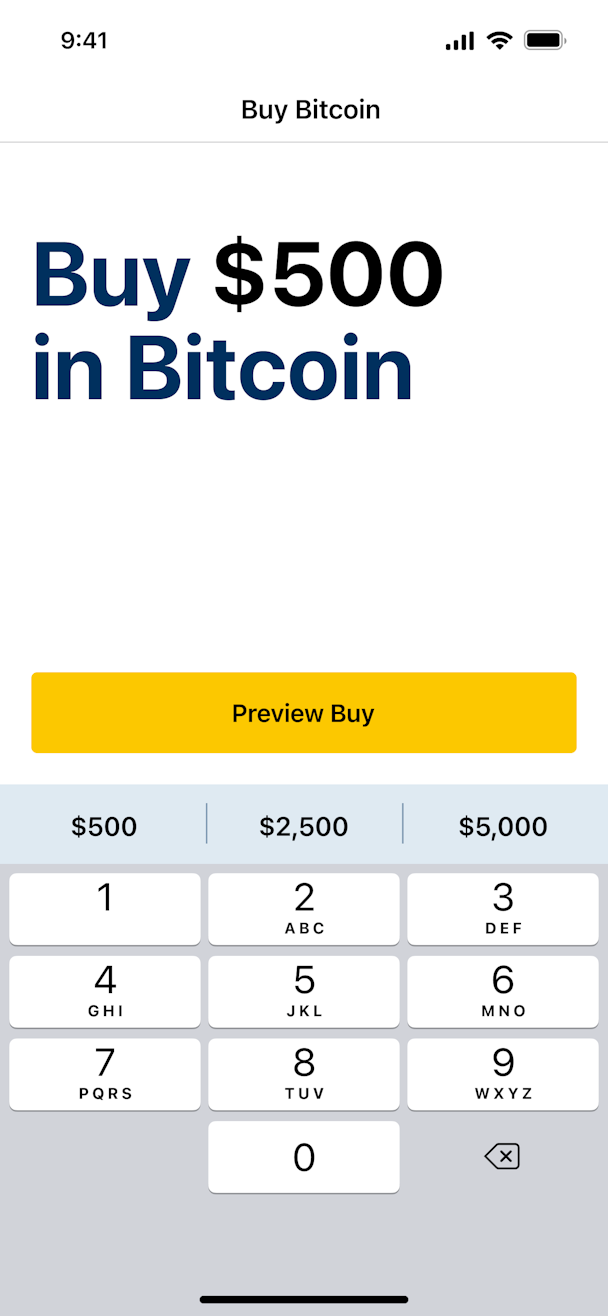

The Swan app is the best way to buy, learn, and earn Bitcoin.

Get the Swan app

Featured in

Recurring buys

Build Your Stack

Steadily convert your dollars into Bitcoin.

Bitcoin, not “crypto”

Why Bitcoin?

Swan focuses on Bitcoin because we believe in its singular power to improve our world. Money is a critical foundation of a thriving society, and our money is broken. Bitcoin is better money to build a brighter future.

- Decentralization Enables a financial system with no central authority

- Store-of-value Provides a hedge against fiat inflation

- Peer-to-peer Facilitates global transactions without intermediaries

- Financial sovereignty Empowers people outside traditional systems

- Transparency Transactions are publicly verifiable

Read, Watch, Listen

Learn About Bitcoin

Media to keep you updated about Bitcoin and the financial world.

Bitcoin 101

By Cory Klippsten

If you are new to Bitcoin, this is the perfect rabbit hole for you! Learn the Bitcoin basics including what Bitcoin is, how it works, and why it’s important. Learn about the history of money and why some common…

Why Bitcoin Exists

By Tomer Strolight

Bitcoin was not created so that some people could “get rich quick.” It was created to preserve the integrity of money — to make the most of your precious time, your energy, and your life.

Why and How Bitcoin Consumes Energy

By Lyn Alden

Bitcoin uses a proof-of-work protocol to operate the network, which means that miners expend real-world resources (electricity) in order to validate transactions and secure the blockchain. Rather than being a bug, this…

Here’s what Swan clients are saying

Rob

World Class Customer Service lives!

I had truly thought the idea of 'World Class Customer Service ' was abandoned and dead. Swan customer service has dispelled that myth! Astonishingly fast trouble ticket responses, consistent updates and final follow through. Perfection!!

Michael

As a loyal customer of Swan since its inception, I cannot speak highly enough about the level of trust, reliability, and exceptional service they have consistently delivered over the years. From the very beginning, they have stood out as a beacon of integrity and dependability in the cryptocurrency space, a rare quality in an industry that often feels like the Wild West.

Stephen

I love Swan!

I feel secure, never had issues with any orders, and when I have questions customer service is great.

JT

The follow up is super

The follow up is super, great, I have text Alec twice, and he followed up in 10 minutes. I have bought crypto on probably 8 other exchanges and the service and follow up was terrible. Swan and Alec are people you can depend on.

Brad

Terrific Company

I’ve been with Swan for 3+ yrs, so plenty of BTC ups and downs. Swan has always provided EXCELLENT customer service in addition to normal operations which are always completed correctly. The website allowing instant and/or recurring purchases and then withdrawals has been flawless. Their efforts to educate (Watch youtube) are genuine and much appreciated! Through difficult times in the mkt or whatever arises, they always come through and perform admirably. Thankyou Swan!!

Jeremy

I had received an e-mail from another company telling me to set up a wallet before a certain date. I strongly suspected it to be a scam but I wasn’t 100% sure that the company wasn’t working in conjunction with Swan and so I was unsure about deleting it. I reached out to Swan’s customer support and they assured me that it was a scam e-mail and that I should delete it. Took a weight off of my shoulders. They even followed up by sending me a great article about how to spot scams.

Troy

Customer service worked diligently through an accounting/banking issue that was frustrating. They kept at it and ended up resolving all of the issues quickly. I appreciated their professionalism in resolving this issue.

Mick

Swan has excellent customer service. They are interested in every user having a smooth and pleasant experience. I received the right support I needed.

Shawn

Great Company

I’ve been using Swan for a few months now. Customer service is excellent. The education materials they provide are superior.

Matthew

Exceptional service, especially as compared with the competition. Resolved an issue and opened my account right away, within an hour or two of contacting customer service.

Ferrari

Thank you for the support and quick response. You guys are so helpful and make stacking bitcoin so simple and safe. Building my portfolio and acquiring wealth with experienced people who truly care and understand the industry unlike many other companies. Financial rockstars and high class service at swan! Thank you swan Bitcoin only 🤘

Christopher

Great customer service over at Swan!

Jason Bassett helped me get my BTC IRA going and he was incredibly helpful. He was always quick to respond to emails, made sure all my questions were answered, and went the extra mile to ensure the process went smoothly. Can’t thank you enough Jason!

Steven

Using Swan is like using a professional. Everything I have done with them has been great and they have supported me in every way. I have been using Swan for a couple years. They are AWESOME.

Michael

I have been thoroughly impressed with the level of service received by Swan through my journey with them. Initially I started with purchasing Bitcoin, then rolled over a portion of an old IRA and tried out the multisig product. I have been pleased with all functions and look forward to being a long time customer. Their Bitcoin only focus was CRITICAL to working with them, but I stay because of the exceptional level of service. Well done!

Mike

I lost all confidence in Coinbase and was surprised that Swan’s customer service was available to help with prompt responses repeatedly.

Sunny

Great company! I’ve been with them two years and the experience has been really good. They’ve offered webinars and other educational tools to familiarize customers with how to reach their financial goals. I also had very good support from customer service when conducting financial transactions. I received regular updates and was quite satisfied with the responsiveness of the staff. Thank you.

Eric

Had a great experience opening an account with Swan IRA recently. Its very reassuring dealing with knowledgeable professionals. Quick replies from the customer service and onboarding teams to ensure that everything is taken care of.

Veraveida

Swan really listens to their customer base. They know how to make money the right way: by providing valuable, honest service.

Jeffrey

The Swan team is very knowledgeable and extremely responsive. You will be pleased with the level of customer service with this Company!

Reza

I absolutely love Swan Bitcoin, and everything they stand for within the bitcoin community. They are authentic, and driven in their pursuit of spreading the good word about the virtues of Bitcoin, and have been a steadfast champion in the community with respect to education.

Jai

I’ve been a Swan customer for a little over a year, and they are by far the best place to buy bitcoin. Almost every single exchange these days lacks direct and personal support, but we’re Swan shines is the availability of support staff through Telegram, email, or private concierge service for private account members. They are light years beyond other exchanges.

Chris

My experience with Swan has been 10X better than the giant Crypto exchange I started out using. Swan is geared toward one thing, BTC. It is straightforward, and simple to use. I was able to set up a quick transfer to get stacked, then set up recurring DCA, and auto-withdrawals to my cold wallet with ease. Their YouTube and other educational content is excellent as well. Swan has a new lifetime customer here!

Michael

I continue to be impressed with their products and the user interface has really improved. The user interface is simple to understand and interact with and the customer service is top notch. Overally I am very impressed with Swan and plan to be a customer for the long term.

Duncan

Great company, great products

Swan is an honest and transparent company with reasonable fees and great customer service. The user interface online is top notch and pays attention to security. Great job Swan.

Jacob

Great company with outstanding customer service. I’ve never waited more than a few hours for an inquiry to be answered. Company has gone over and above multiple times in the few years I’ve been a customer.

Jamie

I am so pleased with the customer service I received at Swan!! I had an issue with a purchase and the Swan team was able to diagnose the problem and back date my purchase to the price at the time. I couldn’t be more grateful for the honesty and transparency. I will continue to recommend Swan to everyone I know!

Join our mailing list…