MSTR vs. GBTC Compared: Which is Best in 2024?

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies in 2024.

MicroStrategy (MSTR)

Bitcoin as Primary Reserve Asset

MicroStrategy (MSTR) uses Bitcoin as its primary reserve asset, providing potential for significant appreciation.

Diversified Operations

With its enterprise software operations and diversified investment approach, MSTR offers a more stable investment profile than the Grayscale Bitcoin Fund (GBTC), which focuses solely on Bitcoin’s price fluctuations.

Substantial Bitcoin Holdings

MicroStrategy is a trailblazer among publicly traded companies for adopting Bitcoin as its main treasury asset.

This substantial investment in Bitcoin positions it as a leader in the corporate crypto space.

Indirect Bitcoin Exposure

MSTR offers a proxy for investors seeking Bitcoin exposure without directly buying cryptocurrency.

Grayscale Bitcoin Trust (GBTC)

Largest Bitcoin ETF

GBTC, the world’s largest Bitcoin ETF, allows investors to buy into Bitcoin as a security, avoiding the complexities of direct purchase, storage, and safekeeping.

Custody through Coinbase

The Trust holds actual Bitcoin securely via Coinbase Custody.

With $22.7 billion in assets under management (AUM), it charges investors a 1.50% annual fee.

High Trading Volume

GBTC experiences a daily trading volume of over 26 million shares, providing substantial liquidity for investors.

Price Movements

GBTC offers direct exposure to Bitcoin’s price movements, making it an attractive option for investors seeking to participate in the cryptocurrency market.

Alternative Investment Strategies

Despite GBTC’s appeal, alternative strategies should be considered, offering better value and diversified exposure.

What if I told you that neither MSTR nor GBTC is your best bet?

MicroStrategy (MSTR): An Overview

Business Transformation:

MicroStrategy is a prominent company that initially focused on business intelligence, mobile software, and cloud-based services.

It has pivoted to Bitcoin-only investments by adding Bitcoin to its corporate balance sheet as the primary reserve asset. Learn more about this strategic move here.

Bitcoin-Only Investment:

MSTR is a software company listed on NASDAQ with a direct Bitcoin-only investment strategy. As explained in this resource, Bitcoin is its primary treasury asset.

Bitcoin as Primary Asset

MSTR’s primary investment focus is Bitcoin, held in its corporate treasury. This reflects the company’s strong belief in the long-term growth potential of digital currency. Read more about this approach here.

Public Company Model

As a public company, MSTR doesn’t charge typical investment fees like management or performance charges.

However, investors should consider the stock price, exchange trading fees, and any premium or discount on the stock compared to its Bitcoin holdings.

Volatility and Link to Bitcoin

MSTR’s stock price is closely tied to Bitcoin’s price movements, resulting in significant fluctuations.

Performance should be assessed considering both the software business and its Bitcoin investments.

In summary:

MicroStrategy’s strategic shift toward a Bitcoin-focused investment model provides a unique blend of a traditional software company and a cryptocurrency investment vehicle.

MSTR’s stock price is closely linked to Bitcoin’s volatile price movements, leading to significant fluctuations. Its performance should be assessed considering both its software business and Bitcoin investments.

Grayscale Bitcoin Trust (GBTC): An Overview

Traditional Investment Vehicle

The Grayscale Bitcoin Trust offers a way for investors to gain exposure to Bitcoin’s price movements without directly managing the challenges of buying, storing, or safekeeping Bitcoin.

Trust Structure

GBTC is a trust that trades over the counter (OTC), offering less liquidity compared to stocks in a publicly traded company.

Direct Bitcoin Holdings

Similar to MicroStrategy, GBTC holds actual Bitcoin, providing more direct exposure to Bitcoin’s price movements. Learn more about its comparative approach here.

Highest Annual Fee

GBTC has the highest annual fee of all 11 approved spot Bitcoin ETFs. Find out more about the competition among Bitcoin ETFs here.

Premium or Discount

GBTC’s price often deviates from the underlying Bitcoin price, frequently trading at a premium or discount.

In summary, Grayscale Bitcoin Trust provides a conventional way to invest in Bitcoin, offering direct exposure through a trust structure. However, investors should consider the liquidity, fees, and price fluctuations before investing.

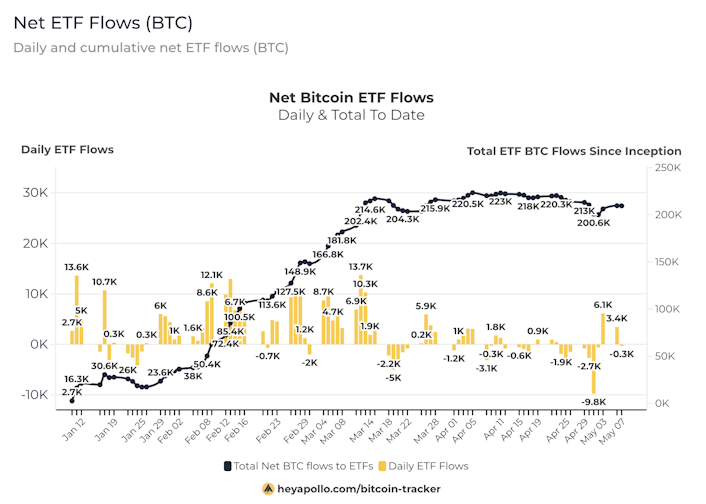

Current Spot Bitcoin ETF Fees

Before we dive in, here are the current spot Bitcoin ETF fees and how many BTC each holds as of May 8th, 2024:

Grayscale: The Grayscale Bitcoin Trust (GBTC) fee is 1.5% — the fund holds 291,877 BTC with Coinbase.

BlackRock: iShares Bitcoin Trust (IBIT) fee is 0.25% fees for the first 6 months (or $5 billion) — the fund holds 274,404 BTC with Coinbase.

Fidelity: Wise Origin Bitcoin Trust (FBTC) fee is 0.25% (with 0% fees until July 31, 2024) — holds 151,877 BTC in self-custody.

Ark/21 Shares: Ark/21 Shares Bitcoin Trust (ARKB) fee is 0.21% (0% fees for first 6 months or $1 Billion) — holds 43,468 BTC with Coinbase.

Bitwise: Bitwise Bitcoin ETF (BITB) fee is 0.20% (0% fees for first 6 months or $1 billion) — holds 33,495 BTC with Coinbase.

VanEck: The VanEck Bitcoin Trust (HODL) fee is 0% of the fund — holds 9,446 BTC with Gemini.

Valkyrie: Valkyrie Bitcoin Fund (BRRR) fee is 0.49% (0% fees for first 3 months) — holds 8,104 BTC with Coinbase.

Invesco: Invesco Galaxy Bitcoin ETF (BTCO) fee is 0.25% — (0% fees for first 6 months or $5 billion) — holds 6,787 BTC wth Coinbase.

Franklin Templeton: Franklin Bitcoin ETF (EZBC) fee is 0.19% — holds 6,002 BTC with Coinbase.

WisdomTree: WisdomTree Bitcoin Trust (BTCW) fee is 0.30% (0% fees for first 6 months or $1 Billion) — holds 1,121 BTC with Coinbase.

Hashdex: Hashdex Bitcoin ETF (DEFI) fee is 0.90% (converted from futures ETF to Spot ETF 03/27/24) — holds 178 BTC with BitGo.

Keep in mind many of the funds offer discounted fees for a limited time period. Also, you’ll want to look at the company backing the ETF and ensure it’s one you trust and choose one of the ETFs that have the most assets under management (AUM).

Want to known more about spot Bitcoin ETF fees? Check out our complete overview.

To stay on top of all the daily inflow and outflow changes, check out our new Daily Bitcoin ETF Show, hosted by Dante Cook.

Check out his most recent episode below…

Direct Exposure to Bitcoin = Increase in MSTR Stock Price

MSTR often mirrors Bitcoin’s market performance due to its substantial investment in the cryptocurrency. When Bitcoin’s value increases, so does the value of MicroStrategy’s holdings, positively affecting MSTR’s stock price.

Since MSTR first invested in Bitcoin on August 11th, 2020.

Investment Structure

MicroStrategy’s direct Bitcoin investment, part of its corporate treasury, allows investors to gain cryptocurrency market exposure through its publicly traded stock MSTR, bypassing the need for direct dealings with cryptocurrency exchanges or wallets.

Lower Fees

Investing in MSTR, a publicly traded company, offers indirect exposure to Bitcoin, avoiding the usual fees for buying, holding, and selling Bitcoin directly.

This approach eliminates typical transaction and management costs associated with buying real Bitcoin.

Regulated Framework

MSTR operates under U.S. regulations for publicly traded companies, offering investors security and transparency. This compliance ensures proper corporate governance and financial reporting, creating a safer and more structured investment environment.

Cons

Market Volatility

MSTR’s heavy reliance on Bitcoin makes its stock susceptible to the inherent volatility of the Bitcoin market.

Bitcoin’s price can be extremely volatile, influenced by regulatory news, technological developments, and market sentiment.

This volatility can lead to significant fluctuations in MSTR’s stock price.

Concentration Risk

MSTR’s significant investment in Bitcoin does represent a concentration risk.

The company’s financial health is closely tied to the performance of a single asset class.

This lack of diversification can be risky, especially if the digital asset market faces downturns or regulatory challenges.

Potential Liquidity Concerns and Impact on Core Business Model

During market downturns or significant drops in Bitcoin’s price,

MSTR could struggle to sell its extensive Bitcoin holdings without affecting it’s stock valuation.

The strong focus on Bitcoin may divert resources from its main business in business intelligence and cloud services, possibly impacting its long-term health and stock performance.

Pros

Direct Exposure to Bitcoin: GBTC holds actual Bitcoin, directly exposing its price movements.

Simplicity: It’s a straightforward way for investors to gain exposure to Bitcoin without the complexities of managing cryptocurrency wallets and keys.

Traditional Investment Vehicle: As a trust, it can be held in certain tax-advantaged accounts, like IRAs.

Cons

Higher Fees: GBTC typically has a higher fee structure due to the costs of securely holding physical Bitcoin.

Premiums or Discounts: GBTC can trade at significant premiums or discounts to the underlying Bitcoin price, affecting investment value.

Less Liquidity: Being an OTC product, it lacks the same level of liquidity as a standard ETF.

ETF Conversion Risk: May be forced to “Sell & Rebuy” Bitcoin as part of the ETF conversion process

Learn how GBTC works, how it’s associated with the recent crypto contagion, and why buying spot Bitcoin and taking self-custody helps you avoid all of these risks today.

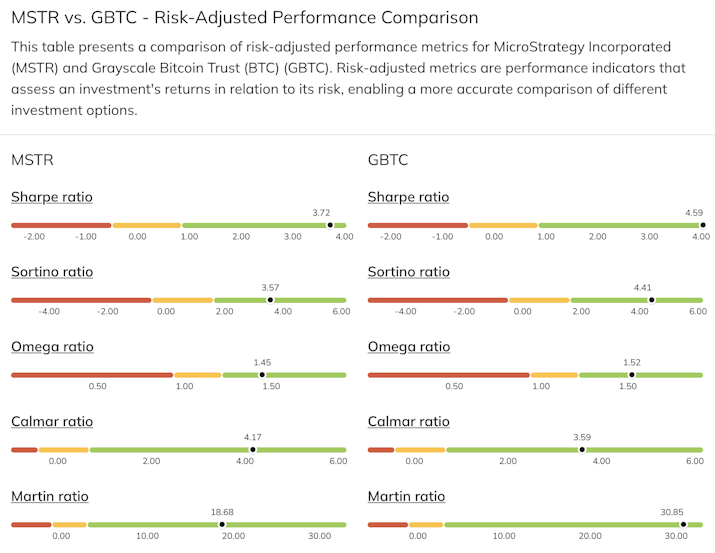

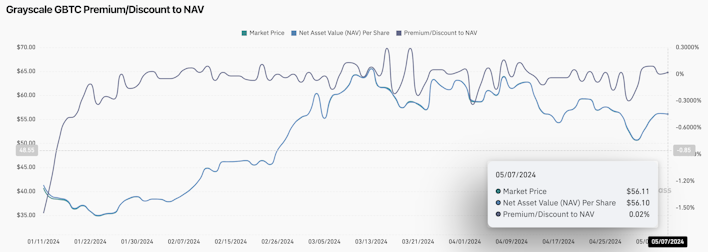

Widening GBTC Discount vs. MSTR Stock Exposure

GBTC Discount

Persistent and Growing Discount

The widening discount has become a significant factor affecting GBTC’s performance, meaning its shares trade below the value of the Bitcoin they represent.

This persistent and growing discount has led investors to question the trust’s attractiveness, as some seek a more accurately priced way to gain Bitcoin exposure.

Structure and Pricing Issues

Trust vs. ETF

GBTC holds actual Bitcoin, providing a direct way to gain exposure to the cryptocurrency.

However, its structure as a trust rather than an ETF has resulted in significant discrepancies between its trading price and the actual value of the Bitcoin it holds.

Shifting from Premium to Discount

Initial Premium, Now Discount

Initially, GBTC traded at a premium but has recently moved to trading at a discount, raising concerns about its effectiveness as a Bitcoin investment vehicle.

Comparing GBTC and MSTR

GBTC Unpredictable Discount: A Risk Factor

Unpredictability of GBTC’s Discount to Bitcoin

Trust Structure and Bitcoin Holdings

GBTC is structured as a trust holding Bitcoin, providing investors exposure to Bitcoin’s price movements without requiring them to directly own the cryptocurrency.

However, unlike traditional ETFs, GBTC shares often trade at a significant discount or premium relative to Bitcoin’s net asset value (NAV).

Measuring the Discount/Premium

Discount/Premium to NAV

The discount or premium to NAV measures the percentage difference between the market trading price of an ETF or closed-end fund (CEF) and its underlying NAV.

This measure is crucial in assessing how much a security’s market price deviates from its intrinsic value.

Impact on Closed-End Funds

Limited Share Creation

Closed-end funds like GBTC do not create new shares after their initial public offering, leading to market prices diverging significantly from the actual value of their assets.

As a result, GBTC can trade at a premium or discount to its NAV, posing a risk to investors who seek predictable pricing.

Investment Risk: Investors in GBTC are exposed to the risk of not only Bitcoin’s price fluctuations but also the variability of the discount. Even if Bitcoin’s price rises, the discount can widen, potentially leading to underperformance relative to direct Bitcoin investments.

Valuation Challenges: The fluctuating discount complicates the valuation of GBTC as an investment. Determining the right entry and exit points becomes more challenging when the discount level is volatile and seemingly detached from Bitcoin’s market performance.

Market Sentiment Indicator: A widening discount might reflect decreasing confidence or increasing regulatory or market concerns, while a narrowing discount could signal growing investor optimism.

Strategic Considerations: A deep discount could be viewed as a buying opportunity, assuming it will eventually narrow. Conversely, a small discount or a premium might signal a good time to sell.

Investment Risk: MSTR’s performance is shaped by its substantial Bitcoin investments and enterprise analytics and software business. This dual focus leads to benefits from Bitcoin’s growth but also exposes it to tech industry risks like competition and tech advancements, creating a distinct investment profile.

Valuation Challenges: MSTR’s valuation is complex, impacted by the volatile value of its Bitcoin assets and enterprise software business performance. Its stock price might not align with its Bitcoin value due to market factors, and its software business is valued based on earnings, growth, and competition.

Market Sentiment Indicator: MSTR reflects Bitcoin market sentiment due to its significant holdings. Its stock benefits from positive Bitcoin investor confidence but can suffer negative sentiment or regulatory issues, regardless of its core business performance.

Strategic Considerations: Investors should assess MSTR’s strategy in balancing Bitcoin investments with its software business.

Exposure Considerations: GBTC closely tracks Bitcoin’s price, while MSTR’s diverse activities beyond Bitcoin can influence its stock.

Risk Tolerance: GBTC’s direct exposure to Bitcoin’s price can be more volatile, while MSTR’s exposure, through its broader business operations, may offer more stability but with different risks associated with its diversified activities.

Diversification Potential: GBTC focuses mainly on Bitcoin, offering limited diversification. MSTR, however, blends real Bitcoin ownership with tech sector exposure and its software business success.

Long-Term Outlook: GBTC’s value depends on Bitcoin’s long-term trends. MSTR’s outlook is tied to Bitcoin’s future, technology, and analytics business growth.

Every Monday — Friday, Dante Cook releases a Bitcoin Daily ETF Show. Check out his most recent episode below…

With all the complexities and downsides, is there a great alternative to MSTR and GBTC with a more straightforward approach?

YES!

Secure your financial future with real Bitcoin from Swan Bitcoin! Don’t settle for mere exposure through a financial product like MSTR, GBTC or BITO.

With Swan, you own actual Bitcoin, even through Swan’s IRA product, ensuring direct ownership of the world’s leading digital asset. Join Swan Bitcoin today and take charge of your investment destiny!

For more information, contact Terrence Yang, Swan Managing Director, at terrence@swan.com or 312.448.8012 (text or call) for details.

Swan is a leading Bitcoin financial services company with more than 120,000 clients and 170 employees, operating globally. Established in 2019, Swan helps individuals and institutions to understand and invest in Bitcoin. The Swan app simplifies Bitcoin purchases with instant and recurring buys. Swan IRA provides a tax-advantaged solution for saving Bitcoin in retirement accounts.

For HNWIs and businesses, Swan Private provides white-glove service for large purchases, treasury solutions, and employee Bitcoin benefits. With Swan Vault, clients can easily custody their own Bitcoin with peace of mind. Financial advisors trust Swan Advisor for client Bitcoin allocations, backed by world-class custody and educational content.

Swan Managed Mining provides clients with fully segregated and dedicated mining operations, catering to their unique requirements, opportunities, and strategic advantages. Swan prides itself on exceptional client service, making Bitcoin accessible to all. For more information, please visit swan.com.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Drew, a class of 2013 Bitcoiner, is a Research Analyst for Swan Bitcoin.

He has worked in institutional VC/PE, FinTech, and DLT consulting for over six years. He also brings over twelve years of experience working with national nonprofits and start-ups in education and software development in several leadership roles.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

Best Bitcoin ETF Fees: Lowest to Highest (May 2024)

By Matt Ruby

In this guide, we analyze and present the top 10 Bitcoin ETFs with the lowest fees for cost-effective investing.

Swan Announces Managed Bitcoin Mining Service

By Swan Bitcoin

Swan Bitcoin launches Managed Mining service for institutional investors, announces strategic collaboration with Tether, targets 100 EH by 2026.

What Is BTC Hashrate? Why You Should Care (May 2024 Update)

By Mickey Koss and Drew

Bitcoin hashrate? Sounds confusing, but its not. Learn the role Bitcoin’s hashrate plays and why its important.