Is Binance in Trouble? Yes, Here Is Why… (May 2024)

The uncertainity surrounding Binance hasn’t become any clearer in 2024. How much trouble might Binance find itself in and what can we expect from the world’s most popular exchange? Let’s dive in!

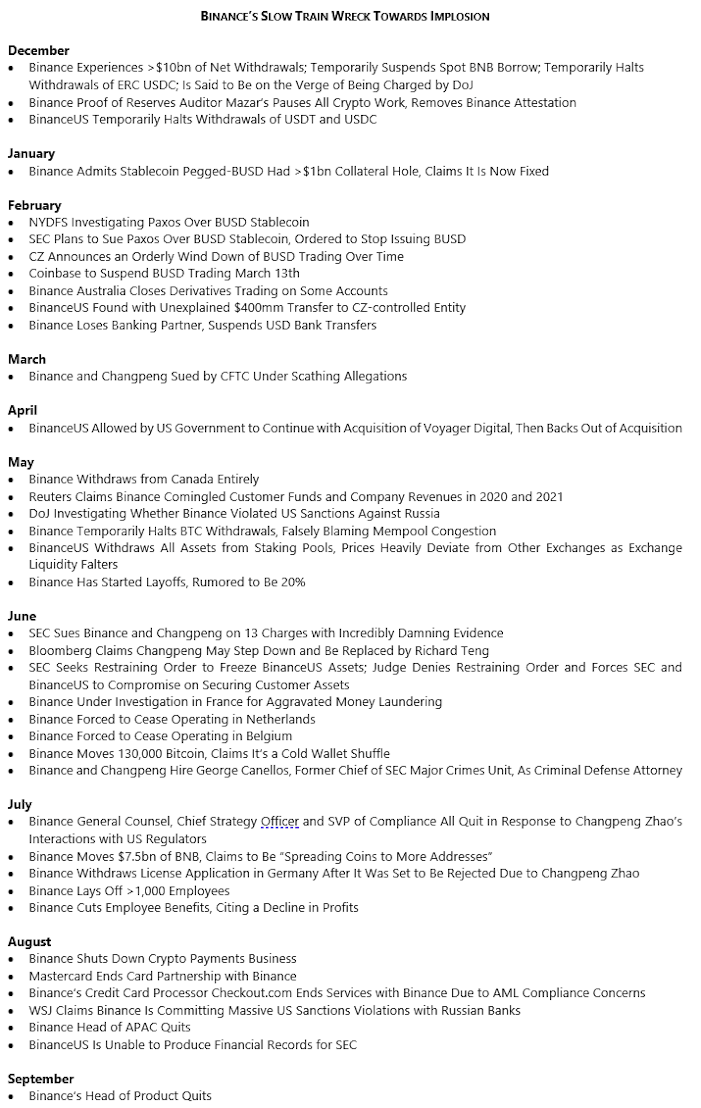

The uncertainty surrounding Binance has never been higher since it was issued a lawsuit by the U.S. Securities and Exchange Commission (SEC) on June 5th, 2022. Join us for this deep dive evaluation of Binance.

In this article, we’ll dive deeply into what CEO and founder Changpeng Zhao (also known as CZ) stepping down means, examine how and if Binance is in trouble, how these new developments will affect its customer base, and what is next for the world’s largest exchange!

What is Binance?

What is Binance?

Binance, launched in 2017 by Changpeng Zhao (CZ), is the world’s largest cryptocurrency exchange platform. It provides a comprehensive platform for buying, selling, and trading +100 cryptocurrencies.

Binance has a native cryptocurrency called Binance Coin (BNB), which can be used for discounted trading fees on the platform and other purposes within the Binance ecosystem.

Spot Trading: Buy and sell crypto directly on the platform.

Futures Trading: Trade futures contracts with leverage.

Options Trading: Explore crypto options for hedging or speculative strategies.

Margin Trading: Access enhanced buying power to maximize potential returns.

Binance also offers its native cryptocurrency, Binance Coin (BNB). Users benefit from discounted trading fees and can utilize BNB for various services across the Binance ecosystem. Learn more about BNB here.

Potential Consequences of Binance Non-Compliance

Important Update: On November 21, 2023, Changpeng Zhao (CZ), the founder of Binance, reached a settlement with U.S. federal prosecutors. This settlement requires Zhao to plead guilty to violating U.S. anti-money laundering laws.

Settlement Terms

Zhao agreed to pay a personal fine of $50 million.

Binance will pay a fine of $4.3 billion as part of the plea deal.

Zhao was released on a $175 million bond and will be sentenced in February 2024.

CZ’s Response

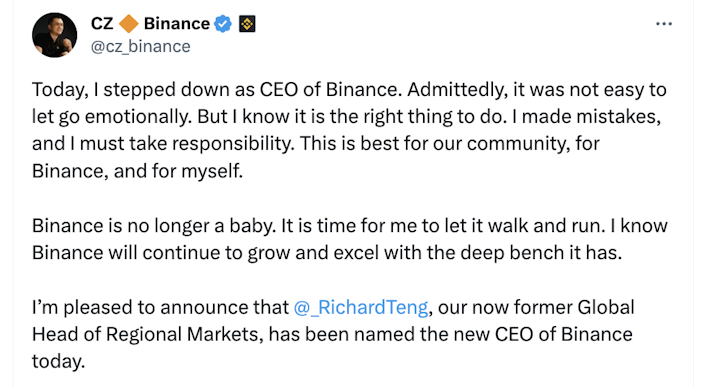

On the same day, CZ announced the news on Twitter:

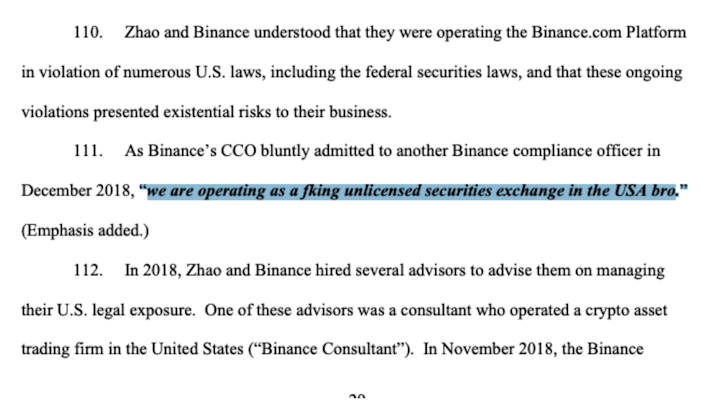

Despite the settlement allowing Binance to continue its operations temporarily, the exchange’s legal challenges remain unresolved. Internal communications from 2018 (just a year after Binance launched) disclosed that compliance issues were acknowledged early on. This history indicates that regulatory scrutiny of the platform is likely to continue.

Reduced Market Access

Non-compliance has led to Binance being denied access to markets, facing operational restrictions, and encountering reluctance from governments and financial institutions to engage with them or their partners.

What Do These Troubles Mean to Investors?

The SEC emphasizes the risks and lack of transparency associated with these platforms. As a result, existing customers risk experiencing a range of adverse outcomes, including but not limited to:

Increased scrutiny of operations

Potential disruptions in services

Withdrawal halt/pause

Increased KYC requirements to fulfill withdrawal requests

Potential legal and financial consequences for the exchange significant loss of liquidity

Main Takeaways for Investors Regarding Binance

A notable observation from recent legal documents is that Bitcoin was mentioned only six times in the 136-page document, none of which had negative implications.

Serious Legal Concerns: Growing uncertainty about Binance’s compliance has led many investors to withdraw Bitcoin from the exchange while seeking clarity on its legal troubles.

Potential Violations: Multiple government lawsuits suggest possible breaches of laws and regulations, including:

Fraud

Wash Trading

Money Laundering

In an April 17th blog post, Swan Lead Analyst Sam Callahan published an in-depth report, Binance: Raising Eyebrows Since 2017, shedding light on long-standing concerns surrounding Binance’s operations. You can access this detailed analysis here.

Exclusive Report Access: The original report was provided exclusively to Swan Private clients on April 14, 2023.

Binance Liquidity Concentration Confirmed by Kaiko

According to Kaiko’s latest Crypto Liquidity Concentration Report, Binance:

Market Depth: Accounted for 30.7% of the global market depth in 2023.

Trading Volume: Controlled a significant 64.3% of global crypto trading volume.

Market Dominance: The report reveals that the eight largest exchanges collectively control 91.7% of market depth and 89.5% of trading volume.

Market Impact: Binance’s dominance means changes in its liquidity, regulations, or operations can significantly impact the broader crypto market.

Learn more details in the Kaiko Insight Report.

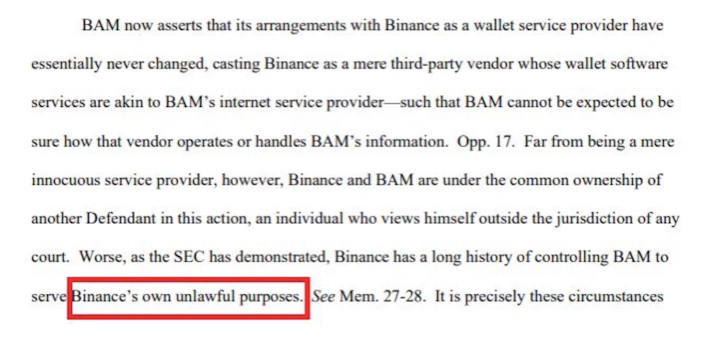

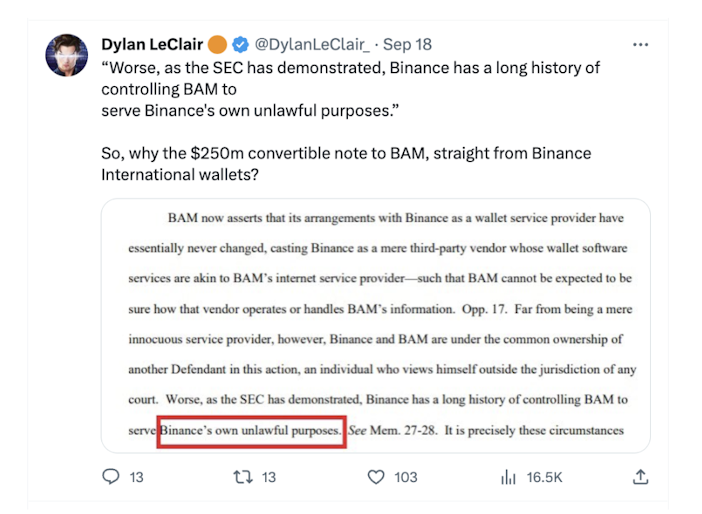

The SEC’s recent filing raises concerns about the audit of Binance.US and highlights difficulties in ensuring the company was fully collateralized.

The filing further alleges that Binance has used BAM, the entity managing Binance.US, for unlawful purposes.

The Wall Street Journal published an exposé over the Christmas 2023 weekend titled The Crypto Queen Pulling the Strings at Binance, shedding light on Yi He’s significant influence over Binance’s marketing and investment operations.

Yi He is a former talk show host and Changpeng Zhao’s longtime romantic partner.

Sept. 6, 2023: Helen Hai announces her resignation

Sept. 6, 2023: Vladimir Smerkis announces his departure

Sept. 6, 2023: Gleb Kostarev announces his resignation

Sept. 4, 2023: Mayur Kamat, product lead at Binance, announces his resignation

Aug. 31, 2023: Leon Foong, head of Asia-Pacific at Binance, announces his resignation

July 7, 2023: Steven Christie, senior vice president for compliance at Binance, announces his resignation

July 6, 2023: Patrick Hillmann, chief strategy officer of Binance, announces his resignation

July 6, 2023: Han Ng, general counsel at Binance, announces his resignation

July 6, 2023: Steve Milton, global vice president of marketing and communications at Binance, announces his resignation

July 6, 2023: Matthew Price, senior director of global investigations and intelligence at Binance, announces his resignation

October 19, 2023: Stéphanie Cabossioras stepped down from her position as the Executive Director of Binance France

October 19, 2023: Saulius Galatiltis has stepped down as chief executive officer of Bifinity UAB, a payment processor that serves as a gateway for fiat transactions by customers of the Binance cryptocurrency exchange

Key Developments Surrounding Binance.US Workforce Cuts and Regulatory Issues

September 13, 2023: Binance.US laid off one-third of its workforce and lost its CEO Brian Shroder.

Employee Concerns

At a summer meeting after the layoffs, employees voiced their concerns to Changpeng Zhao (CZ). According to messages reviewed by the Wall Street Journal, one anonymous employee criticized the lack of advance notice and the two-week severance package, asking if it was a “respectful” way to treat laid-off employees.

Russian Bank Involvement

In late August, the Wall Street Journal revealed that some Binance customers were involved with sanctioned Russian banks. Binance has faced scrutiny over potential violations and addressed the issue by fully exiting the Russian market.

Discontinuation of RUB Support

The decision follows the exchange’s denial of media reports, two months ago, suggesting its involvement in assisting customers in transferring funds from sanctioned Russian banks out of the country.

SEC’s Concerns Surrounding Ceffu and Binance’s Operations

Ceffu’s Role

The SEC is scrutinizing Ceffu, an institutional crypto custodian and Binance partner.

The regulator suspects Ceffu facilitated the transfer of U.S. customer funds between Binance.US and Binance Holdings, potentially moving these funds outside the U.S. jurisdiction.

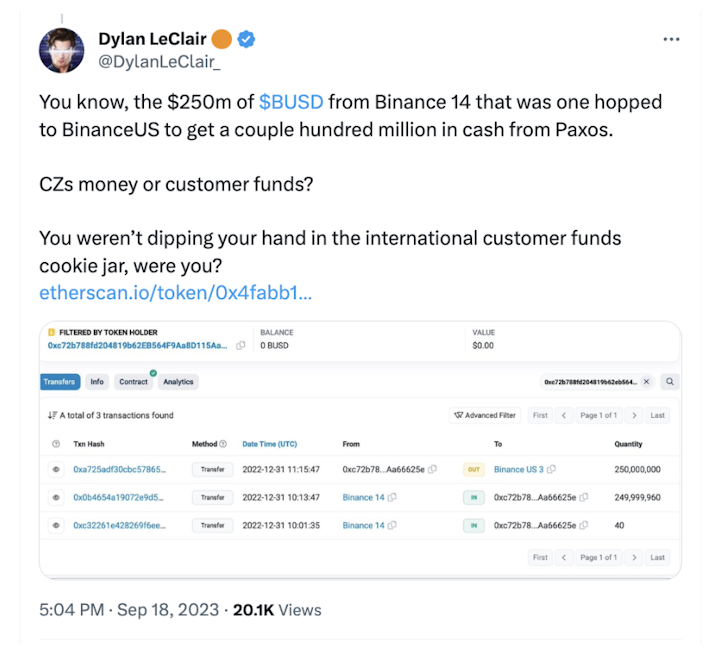

Convertible Note Details

Legal documents from Binance.US’s legal team reveal that BAM Management U.S. Holdings issued a $250 million convertible note to Changpeng Zhao (CZ) in December.

The documents also state that Zhao used Binance USD (BUSD), allocating $183 million to Paxos Trust Company (issuer of BUSD) to convert the stablecoin into USD.

Regulatory Scrutiny

These activities have attracted regulatory attention due to potential financial improprieties, emphasizing the importance of compliant fund management practices within Binance.

Investor Awareness: Keeping up with these developments is crucial for investors to understand the evolving landscape of crypto regulations and potential risks associated with Binance’s global operations.

Learn more about Ceffu here.

Allegations by Dylan LeClair

On Twitter, crypto analyst Dylan LeClair criticized Changpeng Zhao (CZ) for the $250 million BUSD transfer between Binance.US and Binance’s international exchange.

CZ’s Response

CZ responded by stating that “Binance.US has never utilized Ceffu or Binance Custody.”

Unsealed SEC Documents

Newly revealed documents contradict Zhao’s claims, indicating that Binance.US “obtained custody software and support services from Ceffu,” an institutional custodian.

Earlier Reports

In February, Reuters reported that Binance.US transferred $400 million from its platform to Merit Peak Ltd., a trading firm managed by Zhao, based on bank records and internal messages.

October 16th Announcement

On October 16th, Binance.US announced that it would stop supporting USD withdrawals.

Updated Terms

Find the updated terms of use, including the PDF version, here.

Initial Focus on Bitcoin Trading

Initially, Binance had a limited selection of tokens, featuring cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and its native coin, Binance Coin (BNB).

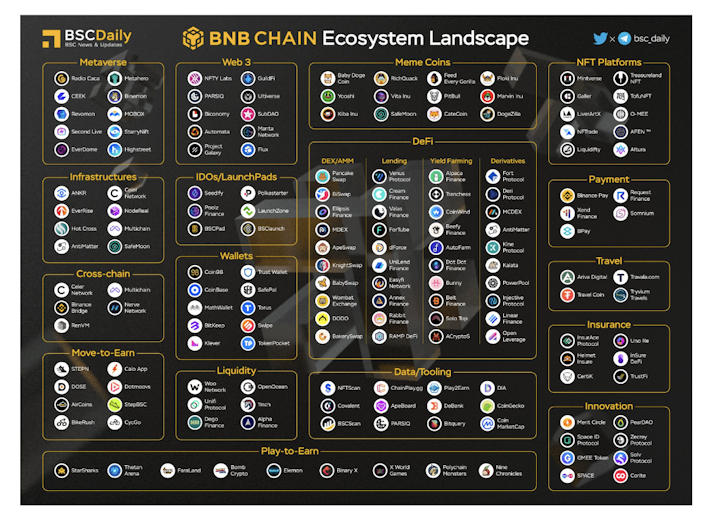

However, it later gained fame for offering an extensive range of cryptocurrencies and digital assets. Binance continues to expand its token offerings and supports launching new projects through programs like the Launchpad platform.

Binance’s initial shift away from Bitcoin to a mostly altcoin-dependent exchange and business model can be attributed to several factors:

Broader asset options

Market demand and trends

Innovation and token launches

Competitive advantage

By expanding its altcoin offerings, Binance attracted traders interested in a broader range of cryptocurrencies. Altcoins often provide different features, use cases, or technologies than Bitcoin, which can appeal to traders seeking varied investment opportunities.

Binance recognized the growing interest and demand for altcoins among traders and adjusted its business model to cater to these preferences.

Binance has actively supported new altcoin projects through Initial Coin Offerings (ICOs) and token launches on its platform. ICOs provide the ideal conditions for a Cantillon Effect distribution of network control by the token team.

Binance’s Shift Away from Bitcoin Dominance: Understanding Its Business Model Evolution

Early Days: Binance initially focused on popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and its native Binance Coin (BNB), offering a limited selection.

Expanded Offerings

Binance gained popularity for listing many cryptocurrencies, evolving its business model to feature many altcoins.

Programs like Launchpad facilitate new project launches, offering token-based fundraising.

Broader Asset Options

By offering more altcoins, Binance enabled traders to diversify their investments.

Market Demand and Trends

Responding to the growing demand for altcoins, Binance tailored its offerings to align with emerging market trends.

Innovation and Token Launches

Binance actively supported new altcoin projects through Initial Coin Offerings (ICOs) and token launches, providing an innovative platform for network growth.

Competitive Advantage

Expanding its altcoin offerings gave Binance a competitive edge, attracting users interested in varied investment opportunities beyond Bitcoin.

Initial Coin Offerings (ICOs)

Binance facilitated ICOs, which enabled altcoin teams to distribute tokens and control the network. Learn more about ICOs here.

Cantillon Effect

The distribution of new tokens often mirrors the Cantillon Effect, where initial participants gain the most benefits. Learn more about the Cantillon Effect here.

Crowdfunding Platform

Binance Launchpad is a Binance-owned crowdfunding platform that helps crypto startups raise funds by offering their tokens to Binance users.

Birth of the IEO Model

Launchpad was the first to introduce the Initial Exchange Offering (IEO) model, a popular fundraising method many crypto startups use across exchanges.

Global Access

Startups can leverage Binance’s global user base to reach a large audience and secure funding.

Secure and Trusted

Users trust the IEO process because Binance vets each project, reducing the risks often associated with other fundraising methods.

Comprehensive Support

Launchpad provides startups comprehensive resources, from project assessment to technical advice and marketing support.

Efficient Fundraising

IEOs offer a streamlined fundraising process through the exchange, giving projects immediate access to funds and participants.

The Launchpad has come under increased scrutiny in recent years for several reasons:

Regulatory compliance concerns

Questions about project quality and due diligence

Allocation and fairness issues

Market volatility and speculation

Investor protection concerns

Definition and Implications of Unregistered Securities

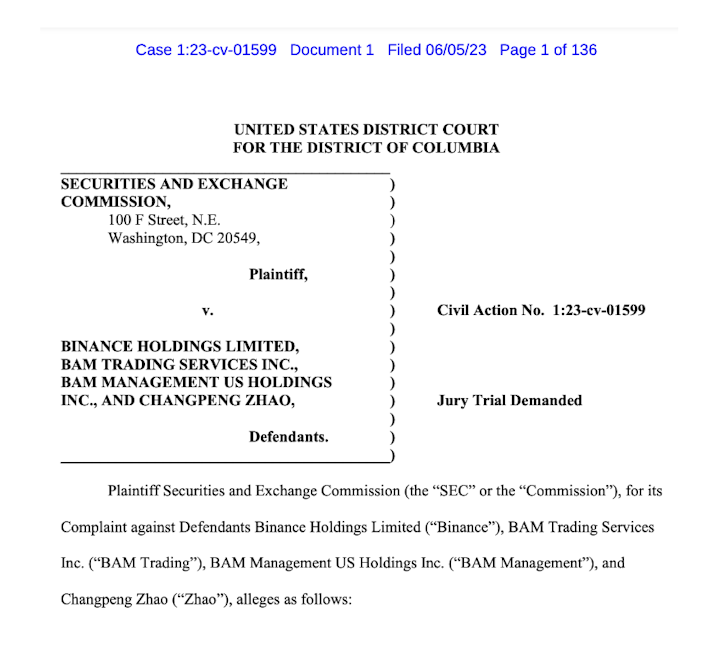

On June 5th, the SEC filed charges against Binance Holdings Ltd., its U.S. affiliate BAM Trading Services Inc., and CEO Changpeng Zhao (CZ) for violating securities laws.

Binance was accused of misleading investors by claiming it restricted U.S. customers from accessing Binance.com while secretly allowing high-value U.S. customers to trade on the platform.

Misleading Investors

Know Your Customer (KYC)/Anti-Money Laundering (AML)

Binance has a notorious reputation for allowing actors to use its exchange for various money laundering schemes, terrorist financing, and other illicit activities.

Exchanges must enforce strong KYC and AML measures to deter money laundering, terrorist financing, and illicit activities.

The U.S. has found evidence that American investors could easily access and use the platform due to lax KYC/AML account setup and maintenance standards.

SAFU?

What is SAFU?

Binance created the 'Secure Asset Fund for Users' (SAFU) in July 2018 to protect user funds.

Binance allocates a portion of its trading fees to this fund, which includes BNB, BTC, USDT, and TUSD wallets.

During unexpected maintenance, CZ tweeted a reassuring message to users:

Origin of the Term

In 2018, a viral YouTube video by Bizonacci popularized the phrase “Funds Are Safu” after CZ reassured users during unexpected maintenance. This meme evolved into a community term meaning user funds are secure

Despite SAFU, user funds are never completely secure on any exchange because withdrawals can be halted at any time for any reason. Users are left with no recourse if this happens.

NOTE: There is nothing the end user can do once this happens.

Binance Proof of Reserves and Security Measures

1:1 Asset Backing

Binance claims its user assets are fully backed at a minimum ratio of 1:1.

However, most of Binance’s corporate holdings are stored in separate wallets not included in proof-of-reserves calculations.

Binance Chain Hack

October 2022 Attack

In October 2022, Binance Chain suffered a hack involving the withdrawal of $2 million BNB, valued at $570 million.

Learn more about the hack and ecosystem update from BNB Chain here.

Protecting Against Scams

Thorough due diligence helps investors safeguard themselves by providing insights into a project’s:

Legitimacy

Team

Technology

Use case and financial health

Due Diligence Criteria

Comprehensive research and analysis should cover the following:

Fundamentals: Key financial and market factors.

Technology: Quality and security of the technology involved.

Team: The qualifications and experience of the project team.

Market Viability: Demand, growth potential, and competitive landscape.

Regulatory Compliance: Adherence to relevant regulations.

Regulatory Challenges

Binance has faced numerous legal issues, including:

Alleged regulatory violations.

Non-compliance with securities laws.

Challenges adapting to evolving regulatory standards.

Legal Challenges Faced By Binance in Various Jurisdictions

Binance operations have faced regulatory scrutiny and legal challenges in several jurisdictions, including:

Regulatory Concerns

Binance had been operating in a limited capacity in the U.S. through its subsidiary, Binance.US.

U.S. regulators have scrutinized Binance’s subsidiary, Binance.US, over compliance issues with local laws, such as registration requirements and potential securities violations.

In June 2023, the SEC charged Binance with misleading U.S. investors

FCA Scrutiny

The Financial Conduct Authority (FCA) demanded that Binance halt its regulated activities and expressed concerns over regulatory compliance, due diligence, and anti-money laundering (AML) measures

The Financial Conduct Authority (FCA) demanded that Binance halt its regulated activities and expressed concerns over regulatory compliance, due diligence, and anti-money laundering (AML) measures.

On October 8, 2023, Binance tried restoring some local services via a partnership with a regulated entity, Rebuildingsociety.com Ltd.

A week later, on October 16, Binance stopped onboarding new U.K. users.

China

Initial Ban

In 2017, China’s government banned domestic crypto exchanges, prompting Binance to relocate its headquarters.

Despite the ban, Binance continues to handle $90 billion in monthly transactions involving Chinese traders, accounting for 20% of global volume

Japan

FSA Warning

In March 2018, the Financial Services Agency (FSA) warned Binance of operating without proper registration

Binance plans to obtain a license to operate in Japan and comply with local regulations.

Canada

OSC Investigation

In March 2021, the Ontario Securities Commission (OSC) accused Binance of violating securities laws by operating an unregistered trading platform.

India

Government Crackdown

In late December 2023, India began blocking local access to international exchanges like Binance, as reported by Bloomberg.

Apple removed Binance, Kucoin, and OKX apps from its App Store after a government order.

On January 12, 2024, Google removed Binance and other global crypto apps from its Play Store in India.

Recent Developments: Key Updates

Monero Delisting

On February 6, Binance announced that it would delist Monero (XMR) from the exchange on February 20, 2024.

CZ’s Guilty Plea

On November 21, 2023, Changpeng Zhao (CZ) pleaded guilty in U.S. court to violating the Bank Secrecy Act by failing to implement adequate KYC and AML protocols for U.S. customers.

As part of the plea deal, he placed $15 million in a trust account and secured guarantors pledging $250,000 and $100,000. CZ is scheduled for sentencing on February 23, 2024.

Fines and Penalties

Zhao and the DOJ agreed to a $50 million fine without prison time mentioned.

Binance will pay $4.3 billion in penalties to various federal agencies and will undergo oversight from multiple monitors for five years.

Settlement Agreements

Binance settled charges with FinCEN, OFAC, and the CFTC, addressing issues related to money laundering, sanctions, and commodities regulations.

CZ’s Resignation

As part of the DOJ settlement, Zhao resigned from Binance and cannot participate in its operations or management for three years following the appointment of a monitor.

Yi He’s Influence

Yi He, Zhao’s romantic partner and the mother of his three children, is now the largest Binance shareholder currently working for the company.

She oversees Binance’s marketing and investment departments and significantly influences the company’s overall operations.

Even though CZ is stepping down, the exchange is not out of the woods yet. Act accordingly. Get your Bitcoin off ALL exchanges today and consider moving it into a Bitcoin IRA.

Holding your Bitcoin in a Swan Bitcoin IRA gives you full control over your Bitcoin. Learn more about the top 6 Bitcoin and crypto IRA options here!

Swan is a leading Bitcoin financial services company with more than 120,000 clients and 170 employees, operating globally. Established in 2019, Swan helps individuals and institutions to understand and invest in Bitcoin. The Swan app simplifies Bitcoin purchases with instant and recurring buys. Swan IRA provides a tax-advantaged solution for saving Bitcoin in retirement accounts.

For HNWIs and businesses, Swan Private provides white-glove service for large purchases, treasury solutions, and employee Bitcoin benefits. With Swan Vault, clients can easily custody their own Bitcoin with peace of mind. Financial advisors trust Swan Advisor for client Bitcoin allocations, backed by world-class custody and educational content.

Swan Managed Mining provides clients with fully segregated and dedicated mining operations, catering to their unique requirements, opportunities, and strategic advantages. Swan prides itself on exceptional client service, making Bitcoin accessible to all. For more information, please visit swan.com.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Drew, a class of 2013 Bitcoiner, is a Research Analyst for Swan Bitcoin.

He has worked in institutional VC/PE, FinTech, and DLT consulting for over six years. He also brings over twelve years of experience working with national nonprofits and start-ups in education and software development in several leadership roles.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

Best Bitcoin ETF Fees: Lowest to Highest (May 2024)

By Matt Ruby

In this guide, we analyze and present the top 10 Bitcoin ETFs with the lowest fees for cost-effective investing.

Swan Announces Managed Bitcoin Mining Service

By Swan Bitcoin

Swan Bitcoin launches Managed Mining service for institutional investors, announces strategic collaboration with Tether, targets 100 EH by 2026.

What Is BTC Hashrate? Why You Should Care (May 2024 Update)

By Mickey Koss and Drew

Bitcoin hashrate? Sounds confusing, but its not. Learn the role Bitcoin’s hashrate plays and why its important.