Bitcoin: The Bear Market King

A new crop of altcoins emerges with each Bitcoin bull cycle. Yet, they inevitably meet the same fate. By illuminating this cyclical trend, we can steer the public away from the risky gamble of altcoins.

Bear markets are often likened to a harsh winter, mercilessly laying bare the survivability of all players in the game.

When it comes to the broader cryptocurrency industry, bear markets are when Bitcoin, the only real player in the game, always shows its strength. With every bear market, Bitcoin typically shines. At the same time, the other highly speculative altcoins fall to the wayside as investors realize that only Bitcoin has a unique value proposition that provides it with the lasting power all others lack.

Back in June of last year, Swan CEO Cory Klippsten and Lead Analyst Sam Callahan observed and showed in charts how altcoins tended to rise with the tide during bull markets but then crashed heavily during bear markets, never to return to their previous all-time highs against Bitcoin in subsequent cycles.

Across Bitcoin’s history, we’ve seen three major bull markets. During each of these runs, a multitude of centralized cryptocurrencies surfaced, promoted with promises of astronomical returns. They claimed their tokens were technologically superior to Bitcoin, captivating naive/gullible retail investors with their false claims.

The result?

A massive wave of speculation and excitement ensued as these investors were convinced they were buying the “next Bitcoin” early. However, reality tells a different tale. These altcoins became fleeting shooting stars; they burned bright in bull markets and then faded away, their sparks unable to ignite lasting interest.

Why?

Simply because they lack Bitcoin’s unique characteristics and value proposition.

Unable to recapture the imagination of investors and lacking any real value or utility, a vast majority of these altcoins disappeared into obscurity or irrelevance, only to be replaced by new cryptocurrencies during the next Bitcoin bull market.

Let’s pause for a moment and ponder over this nugget of wisdom from investor

Howard Marks:

“Rule No. 1: Most things will prove to be cyclical. Rule No. 2: Some of the greatest opportunities for gain and loss come when other people forget Rule No. 1.”

True to this quote, each Bitcoin cycle exposes altcoins for what they truly are — nothing more than volatile, inferior imitations of Bitcoin that surge quickly during favorable times, attempting to capitalize off of Bitcoin’s success, and then tumble just as fast when the tide turns, causing great financial loss to the investors who hold onto them long-term.

But the bear market isn’t all doom and gloom. It offers a golden opportunity for investors to learn about how Bitcoin is different and why it manages to retain its value over multiple cycles as other cryptocurrencies collapse, never to recover. It also allows investors to scoop up cheap bitcoin at bargain prices once they understand this differentiation.

This cyclical trend becomes crystal clear when one watches this fantastic animation that shows how the top 15 cryptocurrencies by market capitalization have fluctuated over the years, while Bitcoin has remained steadfast in the number one spot.

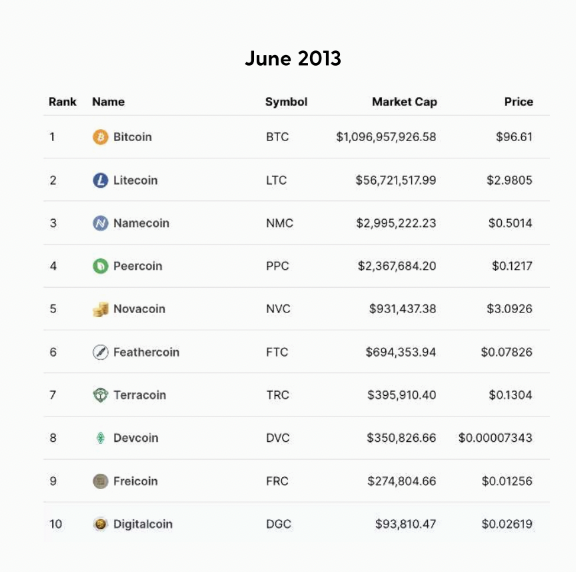

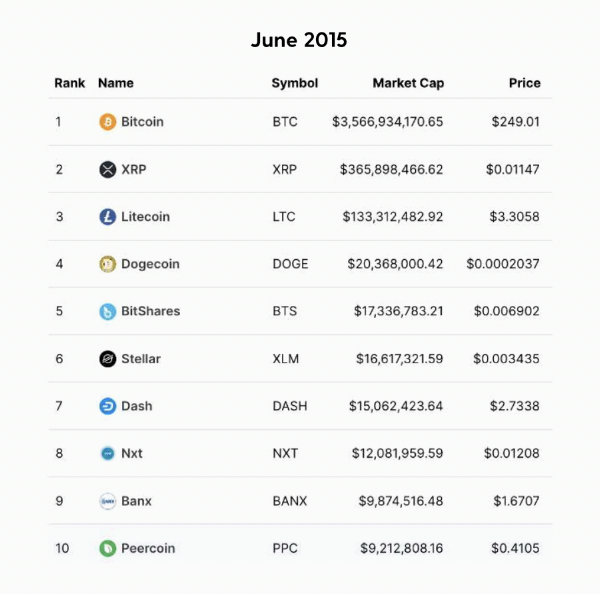

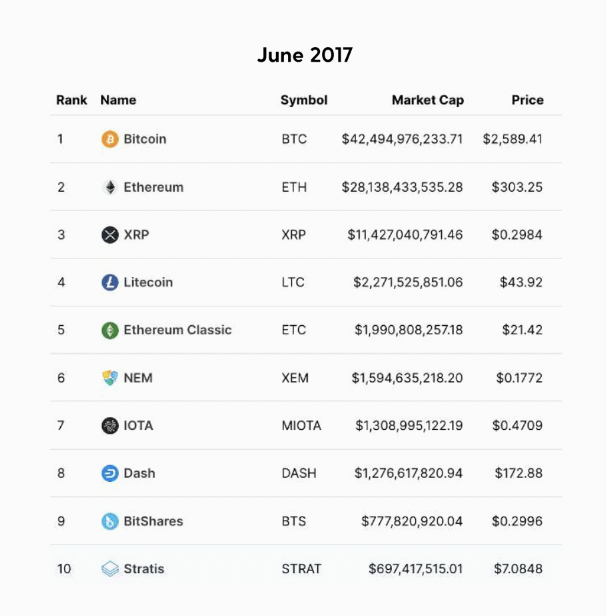

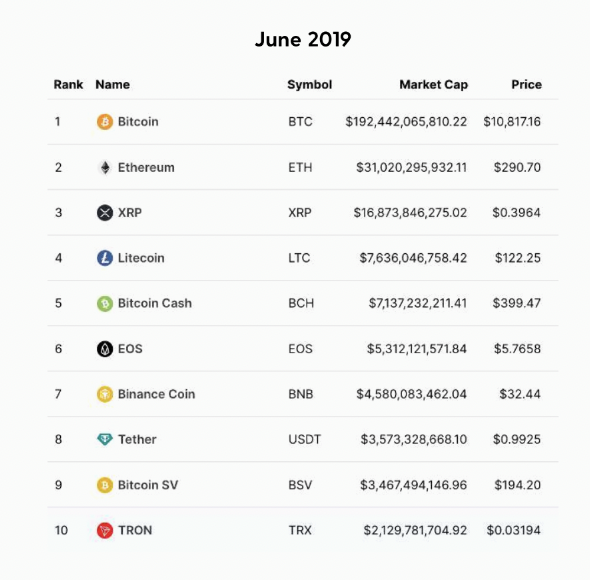

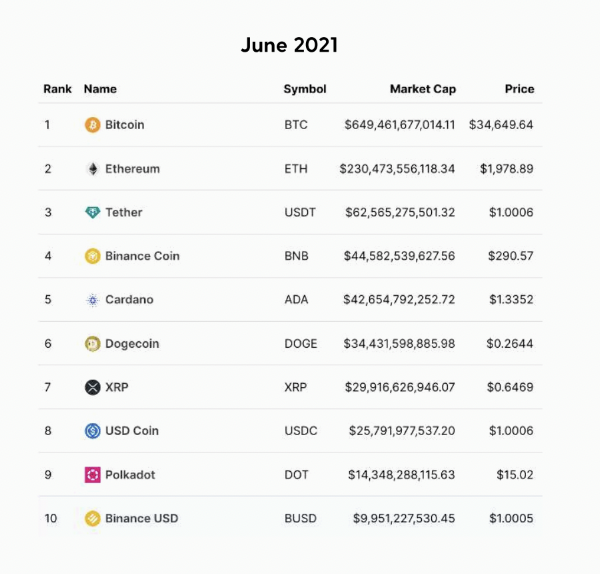

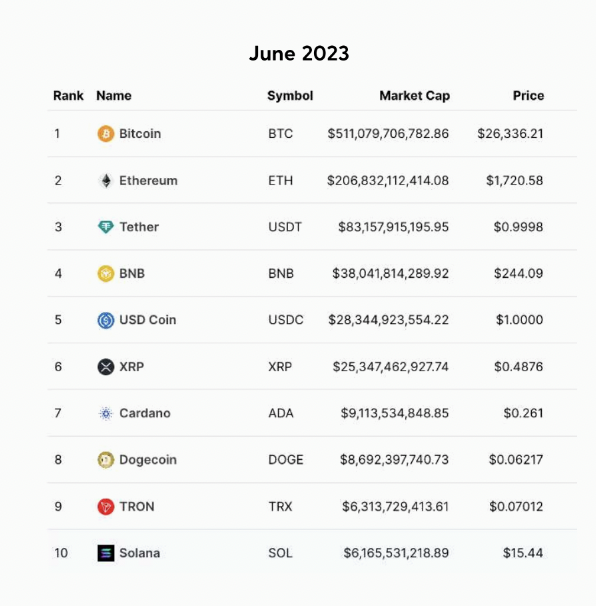

Here are some historical snapshots to drive this point home further. Bitcoin has staying power, while other cryptocurrencies rarely survive multiple cycles.

As you can see, whereas Bitcoin maintains its value over time, other cryptocurrencies rise and fall with each cycle.

Bitcoin OG Jimmy Song recently ran some numbers and showed some more evidence of this trend when he revealed that only 7 tokens out of the top 200 coins in 2018 had a positive return when priced in satoshis since then.

In other words, Bitcoin outperformed 96.5% of altcoins in that timeframe. Over the past year, we have seen this pattern continue to play out.

During this bear market, Bitcoin has outperformed, while many of these altcoins are down massively from their all-time highs.

Bitcoin investor, Brad Mills, created a Tradingview indicator that tracked the total market capitalization of the broader cryptocurrency industry (minus major stablecoins and Wrapped Bitcoin) to investigate how altcoins have performed compared to Bitcoin since the bottom in late 2022.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

An Open Letter to Ann Barnhardt

By Arman the Parman

I decided to write a letter, then made it an open letter, to Ann Barnhardt.

Best Bitcoin ETF Fees: Lowest to Highest (May 2024)

By Matt Ruby

In this guide, we analyze and present the top 10 Bitcoin ETFs with the lowest fees for cost-effective investing.

What Is BTC Hashrate? Why You Should Care (May 2024 Update)

By Mickey Koss and Drew

Bitcoin hashrate? Sounds confusing, but its not. Learn the role Bitcoin’s hashrate plays and why its important.